How Much Is Inheritance Tax 2024 Usa

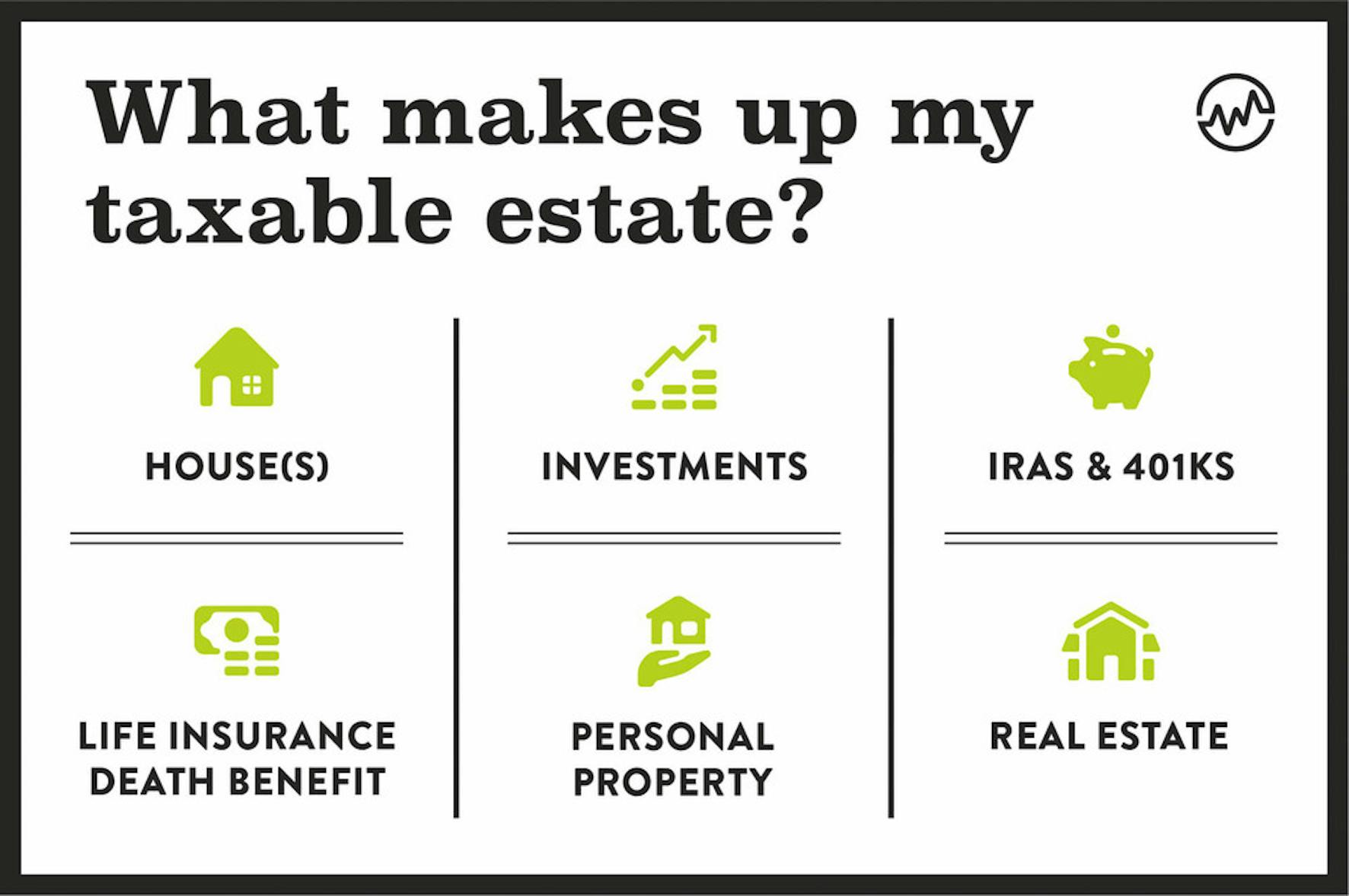

How Much Is Inheritance Tax 2024 Usa. This interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is taxable. This estate may include real estate, cash, investments, personal property, and more.

The tool is designed for taxpayers who were u.s. There is also an option to spread your pay out over 12 months.

On January 1, 2024, The Federal Estate Tax Exemption Increased From $12.92 Million To $13.61 Million Per Individual.

Let’s go over the threshold for foreign inheritance and some of the.

The Good News Is That In 2024, All Inheritances In The U.s.

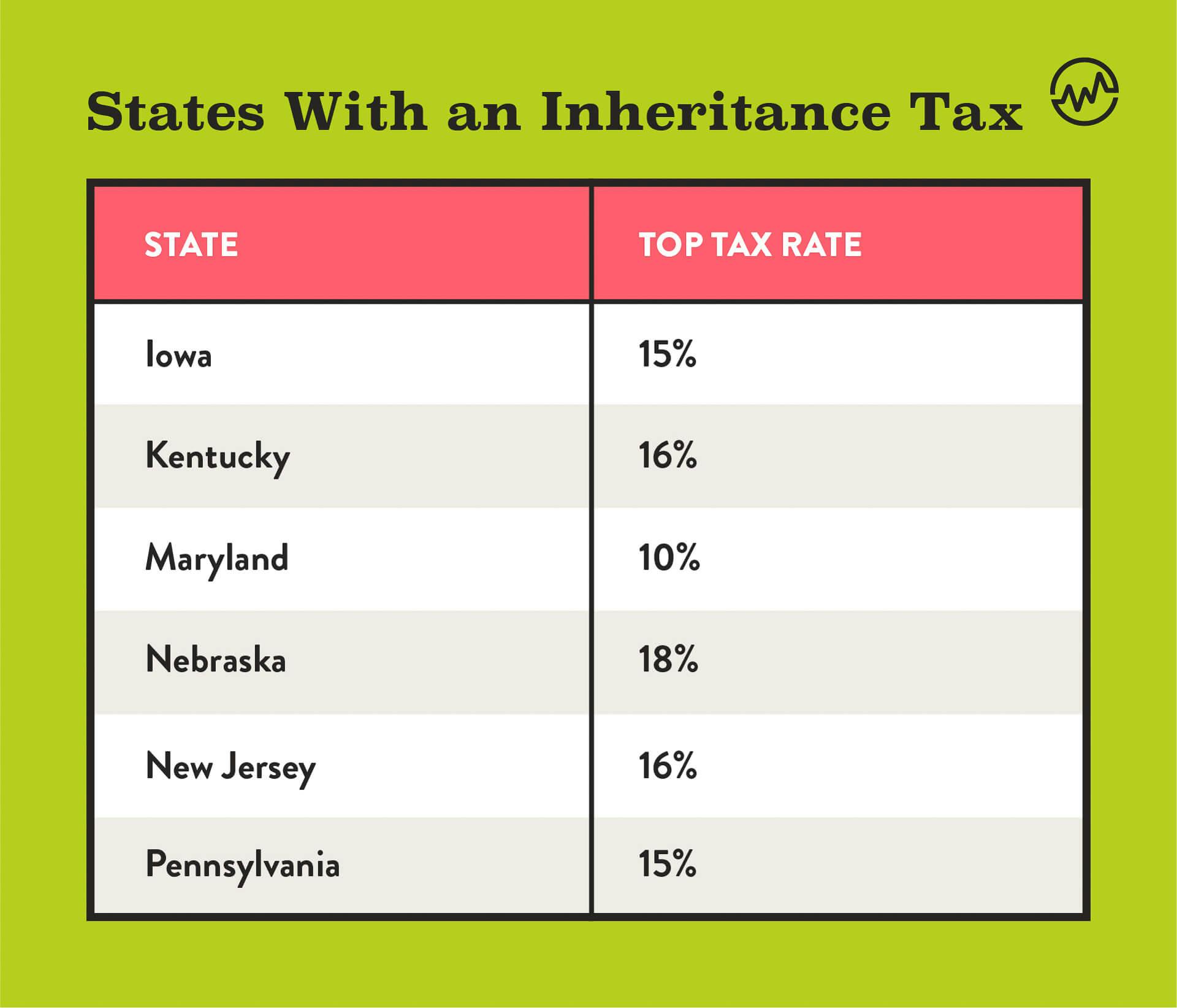

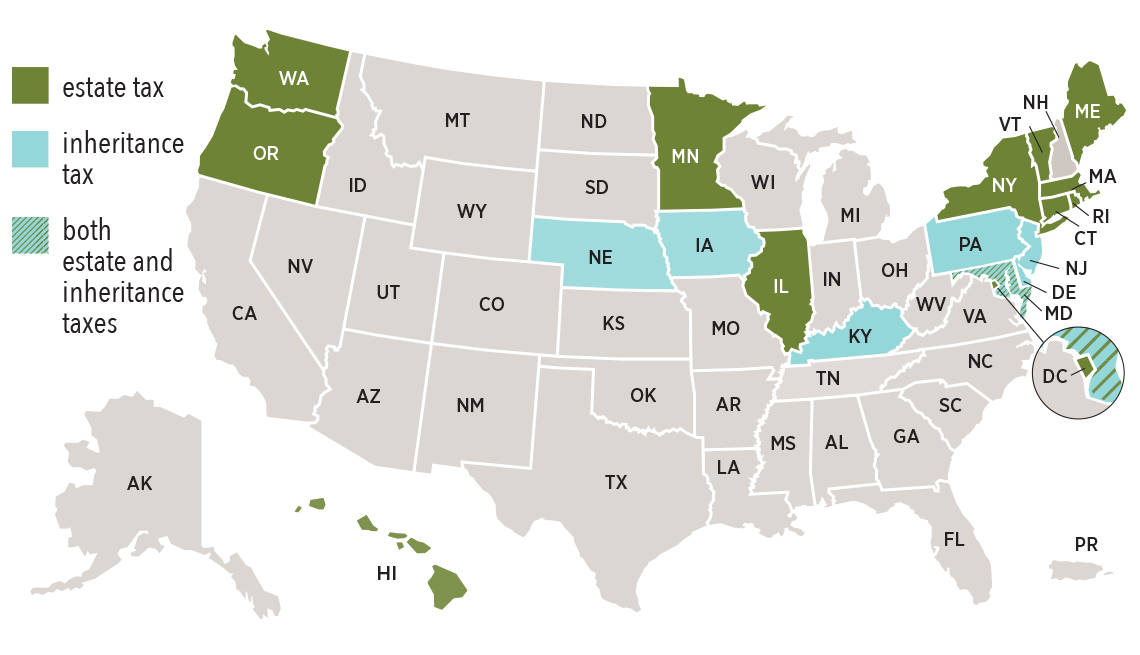

Depending on where the person who died lived, how much the assets are worth and how close you were to the deceased person, you may have to pay an inheritance tax.

How Much Is Inheritance Tax 2024 Usa Images References :

Source: pavlabevelina.pages.dev

Source: pavlabevelina.pages.dev

How Much Is Inheritance Tax 2024 Usa Lenka Nicolea, 600 (may 10, 2024), the nebraska supreme court decided that explicit tax apportionment provisions in a decedent’s revocable trust trumped the state law rule. California residents don’t need to worry about a state inheritance or estate tax as it’s 0%.

Source: www.urban.org

Source: www.urban.org

Estate and Inheritance Taxes Urban Institute, The estate tax is often a topic of concern for those inheriting assets. Some states and a handful of federal governments around the world levy this tax.

Source: eileenqviolet.pages.dev

Source: eileenqviolet.pages.dev

Inheritance Tax Washington State 2024 Alisa Belicia, (getty) inheritance tax in the us is. Most often, this is a $1 state tax and $0.33.

Source: wealthfit.com

Source: wealthfit.com

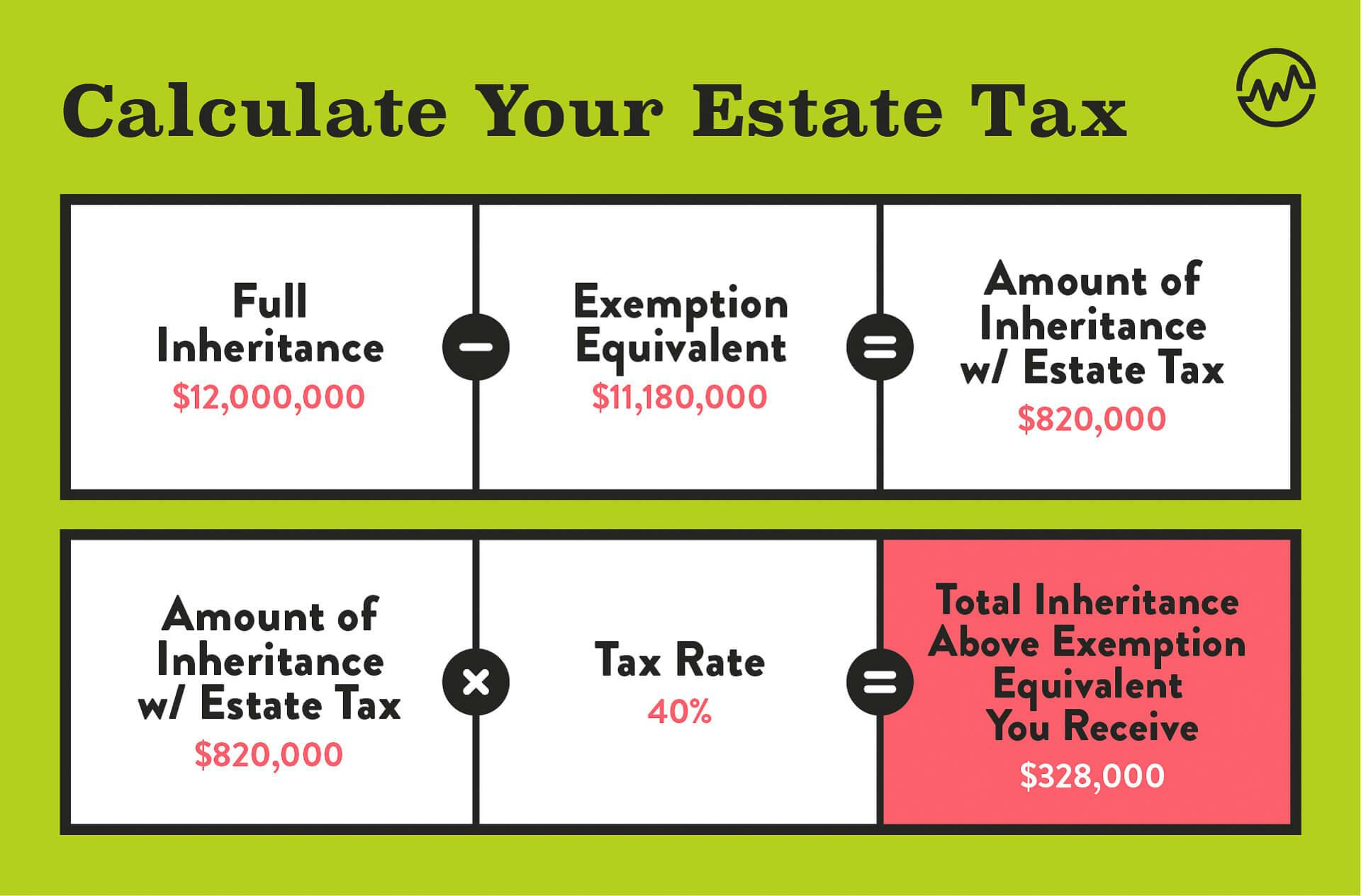

Inheritance Tax How Much Will Your Children Get? Your Estate Tax, 600 (may 10, 2024), the nebraska supreme court decided that explicit tax apportionment provisions in a decedent’s revocable trust trumped the state law rule. Virginia inheritance laws uniquely include a probate tax in the probate process that is based on the value of the estate in question.

Source: wealthfit.com

Source: wealthfit.com

Inheritance Tax How Much Will Your Children Get? Your Estate Tax, Does spanish inheritance tax and spanish inheritance law apply to your worldwide assets? Let’s go over the threshold for foreign inheritance and some of the.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Callback contact +1 514 288. The estate tax is often a topic of concern for those inheriting assets.

Source: legamart.com

Source: legamart.com

Ultimate Guide on Dual Citizenship Inheritance Tax USA & EU, Let’s go over the threshold for foreign inheritance and some of the. Inheritance tax is typically calculated based on the total value of the deceased person’s estate.

Source: www.tododisca.com

Source: www.tododisca.com

Inheritance How much taxfree money can you inherit in the USA?, In this comprehensive guide, we will delve into the intricate world of inheritance laws in spain,. Use our us inheritance tax calculators to estimate inheritance tax on an estate.

Source: wealthfit.com

Source: wealthfit.com

Inheritance Tax How Much Will Your Children Get? Your Estate Tax, The vice president has made clear that climate change is a key issue a harris administration would seek to address. This interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is taxable.

Source: kelcyqolivie.pages.dev

Source: kelcyqolivie.pages.dev

What States Have Inheritance Tax 2024 Kara Sandie, Foreign inheritance tax reporting requirements mostly depend on how much inheritance you receive. Investors have been waiting for clarity from the irs for years after a 2019 law changed the rules.

Depending On Where The Person Who Died Lived, How Much The Assets Are Worth And How Close You Were To The Deceased Person, You May Have To Pay An Inheritance Tax.

Use our us inheritance tax calculators to estimate inheritance tax on an estate.

California Residents Don’t Need To Worry About A State Inheritance Or Estate Tax As It’s 0%.

Foreign inheritance tax reporting requirements mostly depend on how much inheritance you receive.

Posted in 2024